Essential common sense to reduce tax burden for small and medium-sized enterprises

Hello, this is Chajajo Tax Accountant. Today, I will write about the special tax reduction for small and medium-sized businesses, which those who are running small and medium-sized businesses or are in charge of tax affairs at small and medium-sized businesses have probably heard of. If you have taxes to pay but are having difficulty paying them right away due to the burden of the taxes or need a solution due to financial difficulties, it may be a wise idea to appropriately utilize the tax reduction system for small and medium-sized businesses.

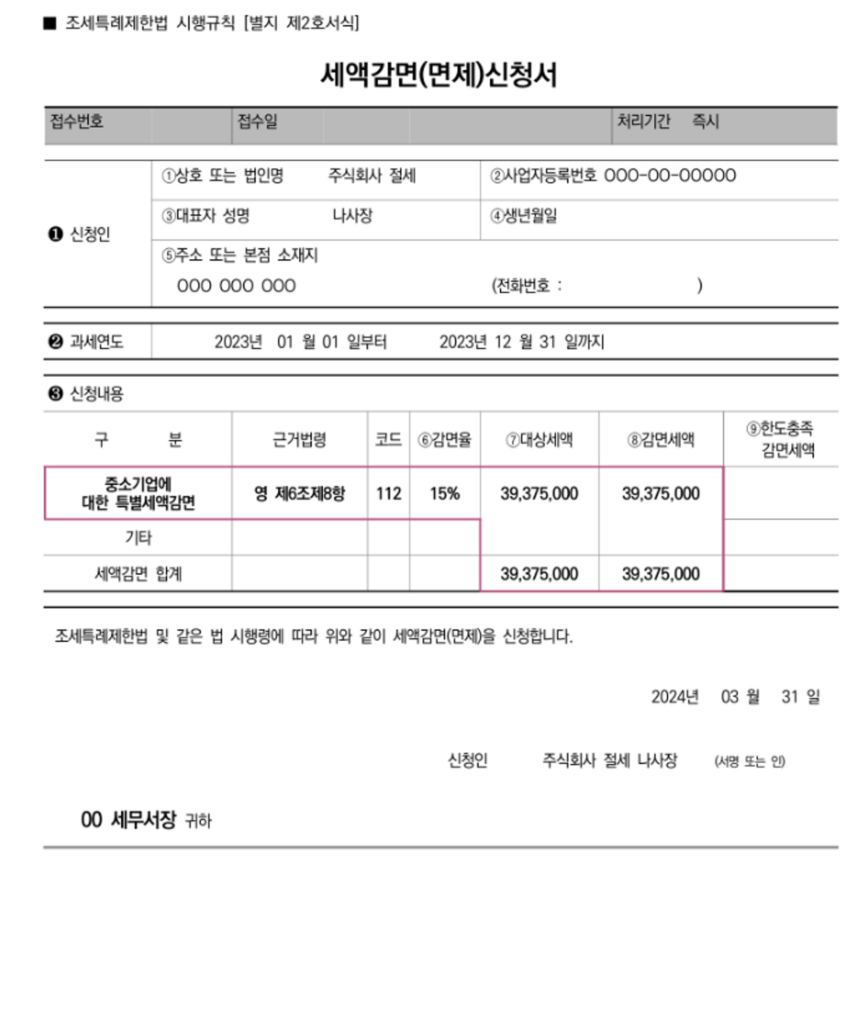

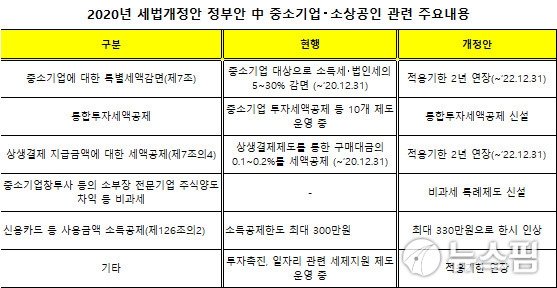

The special tax reduction for small and medium-sized enterprises is a government support system that reduces the tax amount paid by a minimum of 5% and a maximum of 30% for small and medium-sized enterprises with worse management conditions than large corporations or medium-sized enterprises. Unlike the tax reduction system for small and medium-sized enterprises starting up under Article 6 of the Special Tax Exceptions and Restrictions Act, which provides tax reduction for a certain period of time during the start-up stage, this system exceptionally provides reduction regardless of the period during the business stage.

Of course, only small and medium-sized enterprises that meet the special tax reduction conditions for small and medium-sized enterprises can apply for the system. This applies to small and medium-sized enterprises located in the metropolitan area, small and medium-sized enterprises located in local areas, and knowledge-based industry small and medium-sized enterprises located in the metropolitan area.

Please refer to the list of industries eligible for special tax reductions for small and medium-sized enterprises below. Crop cultivation, research and development, exhibition industry, livestock industry, advertising industry, human resource supply and employment agency industry, fishing industry, other science and technology service industry, mining industry, manufacturing industry, call center and telemarketing service industry, packaging and charging industry, business of energy-saving specialized companies, specialized design industry, home long-term care facility operation business, construction industry, contract production industry, sewage waste treatment and raw material recycling, environmental restoration industry, creative and art-related service industry (excluding self-employed artists), building and industrial facility cleaning industry, security and escort service industry, wholesale and retail industry, engineering industry, passenger transportation industry, material industry, market research and opinion polling industry, social welfare service industry, publishing industry, vocational training academy and training facility, intangible property rental industry, business of operating automobile repair shops, production and distribution of video and audio records, research and development support industry, broadcasting industry, ship management industry, telecommunications industry, housing rental management industry, personal care and similar service industry, business related to employee training institutions, medical institutions Operation business, renewable energy generation business, tourism business (excluding casinos and tourist entertainment restaurants), forestry, automobile rental business, customs clearance agency and related service business, security system service business, senior welfare facility operation business, computer programming system integration and management business, etc.

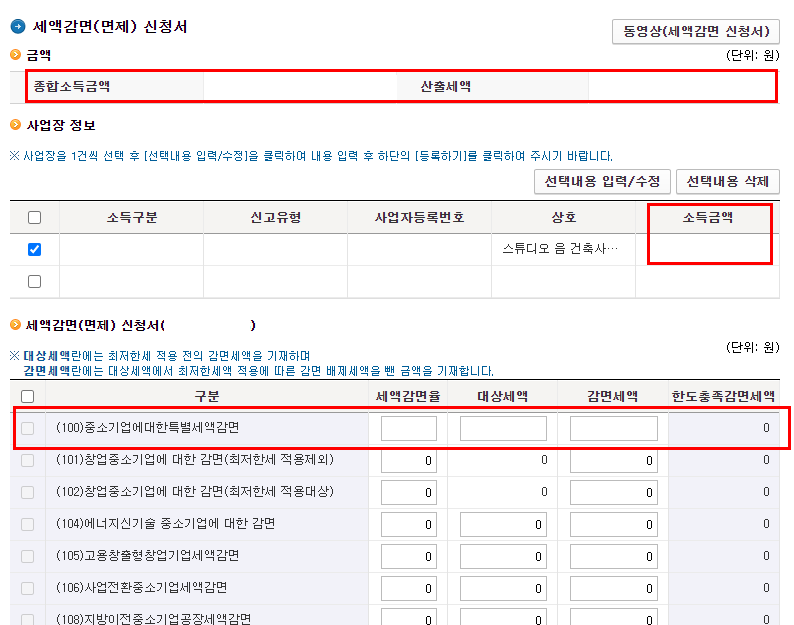

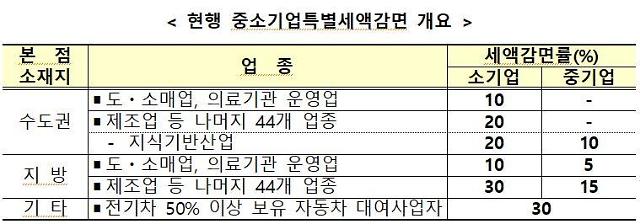

In addition, in order to apply for the special tax reduction for small and medium-sized enterprises, the sales amount must also meet the criteria. Please note that for small and medium-sized enterprises in agriculture, forestry, mining, construction, transportation, and other manufacturing, annual sales must be 8 billion won or less, for small and medium-sized enterprises in manufacturing, 12 billion won or less, and for small and medium-sized enterprises in wholesale and retail, publishing, and video industries, 5 billion won or less. The special tax reduction rate for small and medium-sized enterprises also differs slightly depending on the location of the business establishment. Please refer to the details below. (Small business) 1) If located in the metropolitan area – Manufacturing, etc. > 20% reduction – Wholesale/retail, medical industry > 10% reduction 2) If located outside the metropolitan area – Manufacturing, etc. > 30% reduction – Wholesale/retail, medical industry > 10% reduction (Medium business) 1) If located in the metropolitan area – Knowledge-based industry > 10% reduction 2) If located outside the metropolitan area – Manufacturing, etc. > 15% reduction – Wholesale/retail, medical industry > 5% reduction The special tax reduction rate for small business is up to KRW 100 million, but if the number of regular employees has decreased compared to the previous year, please note that the amount will be reduced by the number of regular employees decreased from KRW 100 million. (* KRW 5 million deducted per person) Today, I have explained the tax reduction system in detail for those working at small business. In addition, there may be those who need expert help with tax affairs. In this case, we recommend that you receive consultation from a tax accountant, so that everyone can smoothly handle difficult tax tasks. – Go to the tax accountant website – I have good news for all small and medium-sized business owners and accountants in the world. It is a government support system called the Special Tax Reduction for Small and Medium-sized Businesses, which is one of the policies that helps small and medium-sized businesses grow and contributes to economic revitalization. Many small and medium-sized business owners may be having difficulties due to tax burdens, but if you utilize this system well, you can significantly reduce your tax burden. However, the most important thing is to know how to utilize it well. So today, we will learn more about the Special Tax Reduction for Small and Medium-sized Businesses and share with you how to utilize it. We have prepared a detailed guide from the qualification requirements for tax reductions to the application method and specific cases of receiving benefits, so if you pay attention until the end of the article, it will be of great help. The Special Tax Reduction for Small and Medium-sized Businesses is a system that reduces the tax burden so that small and medium-sized businesses do not experience management difficulties. It refers to a benefit that reduces a certain portion of taxes when small and medium-sized businesses meet certain requirements. Through this benefit, companies can focus more on management activities and expand investment and employment, etc., and secure the necessary funds for corporate development. The advantage is that there is more room for securing it. The scope of the tax reduction benefit varies depending on the type of company, business content, and region. For example, small and medium-sized enterprises located in local areas or companies actively conducting research and development may receive greater benefits. Of course, in order to receive tax reduction, you must submit related documents within the specified deadline and accurately follow the application procedure, so accurate understanding and preparation for this are essential. In order to maximize the tax reduction benefits, you must accurately know the conditions and required documents that the company must meet. First, check whether it meets the basic requirements for special tax reduction for small and medium-sized enterprises. For example, you must carefully check whether it meets the criteria for small and medium-sized enterprises and whether it satisfies the tax reduction conditions applicable to the relevant business year. In addition, in order to receive tax reduction, you must apply within the specified deadline every year and prepare and submit the necessary documents to the relevant agency. In order to avoid errors in this process, it may be helpful to seek advice from a tax expert. The benefits that can be obtained through special tax reduction for small and medium-sized enterprises are not simply tax reductions, but can lead to various positive effects such as reducing the financial burden on the company and promoting investment and research and development as a result. Therefore, we hope that you will actively utilize the benefits based on your understanding. If you do not know the details about the special tax reduction for small and medium-sized enterprises, this is your chance to learn more about it and secure the financial capacity needed to run your business. If you properly utilize the tax benefits that will serve as a strong support for the growth of small and medium-sized enterprises, the special tax reduction for small and medium-sized enterprises will be a great help in expanding and developing your business in the future. We have looked at a detailed explanation of the special tax reduction for small and medium-sized enterprises and ways to utilize it so far. We hope that this information will be of practical help to your business. We will always strive to provide you with more information and tips while supporting the development of small and medium-sized enterprises. This concludes our in-depth analysis of the special tax reduction for small and medium-sized enterprises. We hope that you will successfully operate your business and that you will be able to have economic leeway through the tax benefits. Those of you who run small and medium-sized businesses, you know how important it is to reduce your tax burden and promote the development of your business, right? Today, we will learn about the special tax reduction for small and medium-sized enterprises, which can be a strong supporter of small and medium-sized enterprises. Through this article, you will learn exactly the conditions for the special tax reduction for small and medium-sized enterprises and how to apply it to your business. Information on tax benefits that will help your business grow to the next level. Let’s get started right now. The special tax reduction for small and medium-sized enterprises is a tax benefit prepared by the government to support the stable growth of small and medium-sized enterprises and economic activation. It provides various tax reductions for the purpose of reducing financial difficulties for small and medium-sized enterprises and promoting investment and job creation. However, in order to receive these benefits, you must meet certain conditions. The conditions may be strict and sometimes feel complicated, but if you check them carefully and prepare, it will be of great help to your business. Let’s take a closer look at the core contents and application requirements of the special tax reduction for small and medium-sized enterprises system. First, let’s look at the basic conditions for receiving the special tax reduction for small and medium-sized enterprises. You must prove that you belong to the category of small and medium-sized enterprises, which is determined by various criteria such as the size of the business, the number of employees, and sales. In addition, if you belong to a certain industrial field or have designated technology, you may receive additional reduction benefits. In addition, the duration of the business, the nature of the corporation, and the location in a specific region Whether or not the business is in operation is an important factor in determining whether or not to receive a tax reduction, and all of these conditions are stipulated with detailed criteria. In order to receive the special tax reduction for small and medium-sized enterprises, the following procedures must be followed. First, you must prepare and check the qualification requirements to determine whether the business is eligible for the tax reduction. In this process, you must prepare the necessary documents and submit related reports within the correct period. You must make a specific plan for the specific business or investment you wish to receive the tax reduction for and systematically manage it to realize it. Therefore, it is recommended that you seek advice from a tax accountant or expert. Consult with an expert and make a plan to receive the optimal tax reduction benefit for each business. In conclusion, the special tax reduction for small and medium-sized enterprises is an important policy tool to support the growth of small and medium-sized enterprises and contribute to economic development. If you make good use of the tax reduction benefits, it can greatly contribute to increasing the stability of the business and creating more investment and employment. It can be said that it is an important task for small and medium-sized enterprise managers to thoroughly understand the benefits and use the special tax reduction for small and medium-sized enterprises under appropriate conditions. Today, we looked into the conditions for the special tax reduction for small and medium-sized enterprises in detail through this article. If you have any questions, please seek the advice of an expert or contact a related organization to obtain more detailed information. I hope you will actively utilize government support until the day when the future becomes bright.